Why NSW for copper

• Second largest Economic Demonstrated Resource (EDR) in Australia

• More than 21.3 Mt in current resources

• The Macquarie Arc in the Lachlan Orogen is a world-class region for exploration

• Established copper mining jurisdiction with 5 operating mines

• More than 10 projects in development

Overview

Copper is one of the world's most important metals as it conducts heat and electricity more efficiently than many other metals. It is essential for renewable energy systems including solar, hydro, thermal and wind energy and underpins transmission infrastructure.

Copper’s use in consumer goods, construction, transport, industry, and infrastructure, especially power generation and transmission, means that demand is closely tied to world economic growth.

Copper will play a critical role in the global renewable energy transition. In 2022 around 20% of copper demand was for new energy technologies and electrification and by 2030 this could be as high as 30%. Overall demand for copper is forecast to increase from around 26 million tonnes (Mt) in 2023 to over 33 Mt by 2030 (Source: IEA).

Copper prices are expected to increase until 2030 because production is unlikely to keep up with demand. Planned expansions of existing mines and development of new mines would see production increase to around 30 Mt a year by 2030 (Source: S&P Global).

In NSW large reserves of copper and strong mining industry present investors with many opportunities to capitalise on the looming copper shortage.

NSW resource

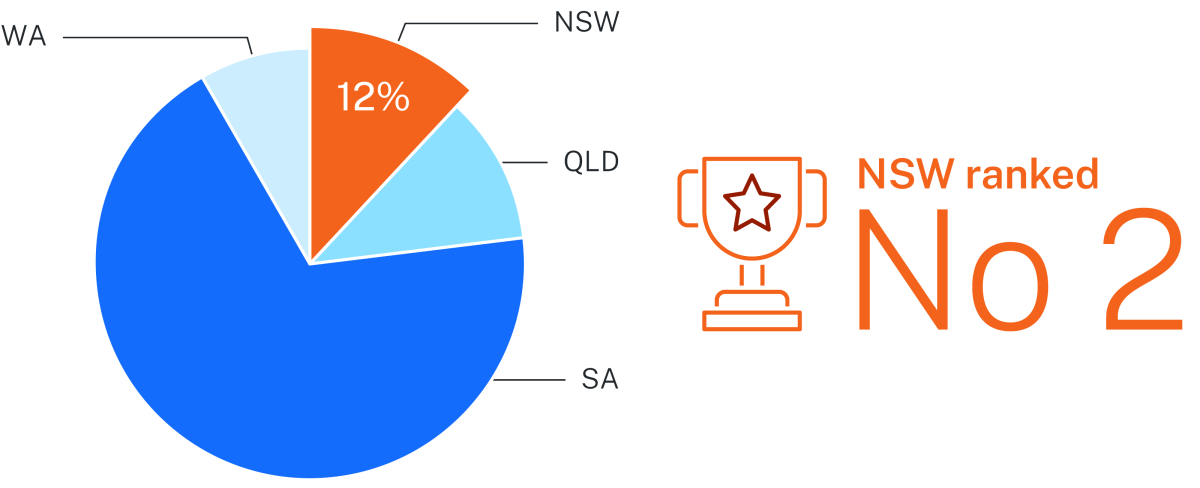

NSW is ranked second in Australia for copper contained resources, holding 12% of Australia’s EDR of copper (Source: Geoscience Australia, Australia's Identified Mineral Resources 2023).

NSW has a diverse range of copper-rich deposits where copper is produced as either the principal commodity (Northparkes, CSA and Tritton mines) or as a concentrate with significant copper credits.

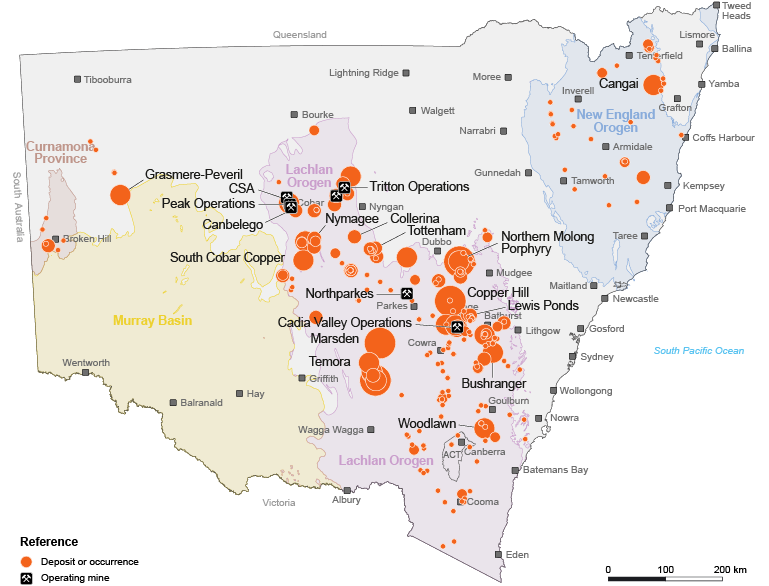

Copper mineralisation in NSW is predominantly associated with the world-class Macquarie Arc and Cobar Basin in the Lachlan Orogen. Copper-enriched systems in this region include the porphyry copper-gold and related skarn deposits, such as the Cadia district (Cadia East) and the Northparkes, Copper Hill and Temora districts. The New England Orogen and Broken Hill region are also prospective for copper.

NSW remains under-explored for copper, especially under cover, including less than 500 metres in several areas. There are a range of opportunities for new discoveries, especially in the Macquarie Arc which has the highest density of known and undiscovered deposits. Drilling beneath known mineralisation along the eastern margin of the Cobar Basin has consistently met with exploration success.

The Macquarie Arc will remain the dominant source of copper in NSW until 2050.

Copper in NSW map

Download the Copper in NSW map (PDF, 3.07 MB).

Essential uses

Electrification and transmission |

Solar PV |

Wind turbines |

Electric vehicles and charging |

Electronics |

Scientific and medical instruments |

Quality data for explorers

NSW is known for its world class pre-competitive data, and has a long history of providing geological, geoscientific and geochemical data to promote investment in exploration.

Pre-competitive data to support copper exploration (and other commodities) is made freely available on the Geological Survey of NSW’s web map application MinView.

The NSW Government recently completed its largest ever geophysical survey acquisition program through airborne electromagnetic, airborne magnetic and radiometric, gravity, and deep crustal reflection seismic surveys. These surveys collected over 150,000 km2 of new data across the New England Orogen, the Lachlan Orogen and the Murray Basin areas that are prospective for critical minerals and high-tech metals, including copper.

Global overview

Global reserves are currently estimated to contain one Mt of copper, or approximately 43 years’ worth at 2021 production rates. Latin America (Chile and Peru) has the largest known copper reserves and is expected to remain the largest producer of copper for the foreseeable future. Australia has the third largest reserves of copper in the world and is the world’s eighth largest producer.

China is the largest producer of refined copper with over 40% of the world smelting capacity – one third of the world’s smelting facilities. China uses over half of the world’s refined copper.

Copper is an extremely recyclable metal able to be used multiple times without performance loss. Historically, 30% of world copper consumption was recycled copper.

2023 Global copper reserves – 1 billion tonnes copper content

2023 Global copper production – 22 million tonnes copper content

Source for global overview content and charts: modified from USGS Mineral Commodity Summaries 2024.

NSW operating mines

NSW is an established copper producer and Australia’s second largest copper producing state. Four of NSW’s copper mines are in Australia’s top 10 copper producing mines, including Cadia Valley Operations, CSA, Northparkes and Tritton Copper Operations.

NSW is experienced with hosting technically sophisticated mining operations including leadership in automation and underground remote operations. The state has the first block-cave copper operation at Northparkes mine, a mining method that is expected to play a key role in future low-impact production. Cadia Valley Operations is a highly productive gold and copper operation (one of the world’s largest deposits) with a reputation for advanced digital and resource technology applications. The more historic operations in the Cobar region hold a strong reputation for technical excellence in geotechnical, deep mining and ventilation practices.

Production in NSW

Over the past 5 years, NSW copper production has averaged nearly 200,000 tonnes a year (Source: NSW Resources), however there is potential to increase future supply up to 400,000 tonnes each year (Source: S&P Global mine forecasts).

Major copper mine production

Processing in NSW

Many of the copper operations in NSW have established processing plants to produce copper concentrates (or similar) ready for further refining or smelting. A number of plants across NSW currently run below capacity, presenting opportunities for partnerships.

Copper processing plants and capacity

NSW project highlights

NSW is well positioned to bring on new supply of copper with a strong pipeline of projects at advanced development stage and advanced exploration stage. There have also been successful project expansions, with recent inventory growth including at Northparkes (a cluster of porphyry deposits).

At the greenfield stage, the recent Boda–Kaiser porphyry (Northern Molong Porphyry project) highlight the NSW Central West region’s exploration potential for large, shallow deposits. With a strong pipeline of opportunities and a region with exploration potential, NSW will remain a leading copper producing state over the medium to long term.

| Project (deposit) |

Contained Cu ('000 t) |

|---|---|

| Bushranger Copper-Gold |

1,052 |

| Canbelego Copper |

32 |

| Cangai Copper |

114 |

| Collerina |

41 |

| Copper Hill |

532 |

| Federation |

14 |

| Koonenberry (Grasmere–Peveril) |

59 |

| Lewis Ponds |

12 |

| Mineral Hill |

89 |

| Northern Molong Porphyry (Boda–Kaiser) |

1,535 |

|

South Cobar Copper

|

197 |

| Tottenham |

99 |

| Tritton Operations (Constellation expansion) |

122 |

| Woodlawn zinc-copper |

185 |

| Yeoval Porphyry |

49 |

| Note: The contained copper totals are based on combined resources for that project (i.e. the amount of copper as a metal that is contained within one or more resources). Source: New South Wales MetIndEx database. | |

Notes:

All percentages (including in the pie charts) are rounded to whole numbers.

Forecasts are based on NSW Resources’ interpretation of available information. Forecasts are inherently uncertain and should be seen as a guide only. Actual outcomes may be different.