Paying royalties

Mineral resources in NSW are mostly owned by the Crown. This means that the royalties and economic benefits from mining contribute to providing services to the people of NSW.

Introduction to Mineral Royalties

Under the Mining Act 1992, royalties are payable for:

- non-coal minerals that are extracted

- coal that is extracted and sold, or used by the holder of a mining lease.

Obligations to pay royalties for petroleum come from the Petroleum (Onshore) Act 1991.

The royalty regimes for coal, non-coal and petroleum are all slightly different. In general, the holder of a mining lease or sub-lease is liable to pay royalties.

In NSW, most minerals are owned by the state. Royalties from state-owned minerals go into consolidated revenue and are allocated for the provision of services to the people of NSW through the budget process. Some minerals in NSW are privately owned. Royalties from privately owned minerals are collected by the state but 7/8ths are returned to the owner of the mineral. In general, gold, silver, coal and uranium are publicly owned, and other minerals can be privately owned.

Mineral royalties are jointly managed by NSW Resources within the Department of Primary Industries and Regional Development, and Revenue NSW.

Assessment, audit and collection of mineral royalties

Like income tax, mineral royalties are ‘self-assessed’. This means that the holder of a mining lease is required to assess their own royalty liability, lodge their own returns, and pay their royalties by the due date. Leaseholders are also required to keep records for seven years that would allow their returns to be audited.

Revenue NSW is responsible for the audit and collection of mineral royalties. They have a range of additional powers under the Taxation Administration Act 1996 that make them the appropriate agency.

For more information go to the help with online services at Revenue NSW .

For all enquiries about the Royalty Online Services (ROS) system and payment of royalties, contact Revenue NSW at mineralroyalty@revenue.nsw.gov.au or by phone on 1300 139 817 or 02 7808 6915.

Royalty returns and payment due dates

The following table shows the due dates for royalty returns and royalty payments for each of the are to be lodged and the due dates.

| Mineral type | Lodgement frequency | Due date |

|---|---|---|

| Coal | Monthly | 21 of every month |

| Petroleum | Monthly | Last day of calendar month |

| Non-coal minerals where annual royalty from the mining lease is less than $50,000 | Quarterly |

|

| Non-coal minerals where annual royalty from the mining lease is greater than $50,000 | Annually | 31 July each year |

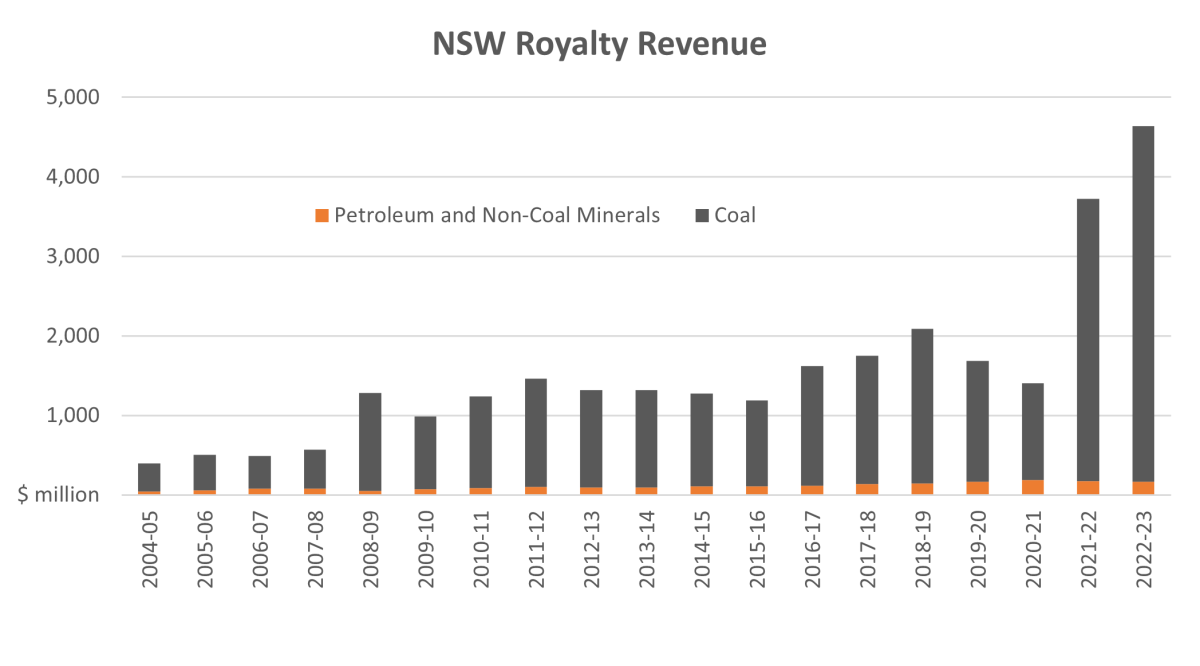

Royalty revenue

In 2022-23, $4.64b in royalties were collected from the NSW mining industry and coal accounted for over 96 per cent of that amount.

Table: Royalty revenue ($ million, nominal terms)

| Year | Petroleum and Non-Coal Minerals | Coal | Total |

| 2004-05 | $41.96 | $354.41 | $396.37 |

| 2005-06 | $56.15 | $447.57 | $503.72 |

| 2006-07 | $76.96 | $411.94 | $488.90 |

| 2007-08 | $79.17 | $494.39 | $573.56 |

| 2008-09 | $53.66 | $1,228.87 | $1,282.53 |

| 2009-10 | $69.93 | $915.36 | $985.29 |

| 2010-11 | $88.06 | $1,152.27 | $1,240.33 |

| 2011-12 | $103.02 | $1,361.38 | $1,464.40 |

| 2012-13 | $94.67 | $1,223.78 | $1,318.45 |

| 2013-14 | $96.06 | $1,225.19 | $1,321.25 |

| 2014-15 | $112.45 | $1,161.91 | $1,274.36 |

| 2015-16 | $106.33 | $1,083.98 | $1,190.31 |

| 2016-17 | $116.60 | $1,502.16 | $1,618.76 |

| 2017-18 | $138.01 | $1,614.44 | $1,752.45 |

| 2018-19 | $144.89 | $1,948.01 | $2,092.90 |

| 2019-20 | $163.54 | $1,523.88 | $1,687.42 |

| 2020-21 | $185.64 | $1,219.49 | $1,405.13 |

| 2021-22 | $170.40 | $3,553.56 | $3,723.96 |

| 2022-2023 | $166.71 | $4,471.72 | $4,638.43 |

Coal royalties

Royalties are levied on all coal recovered in NSW and they are calculated in the following ways:

- Ad Valorem Royalty - Royalty for coal is a percentage of the value of production less allowable deductions, calculated as per the Ministerial Determination (PDF, 615.48 KB). The percentages are 8.8 per cent for coal extracted from below 400 metres, 9.8 per cent for coal extracted underground but above 400 metres, and 10.8 per cent for coal open cut mines.

- Coal Reject Royalty - The rate of royalty for coal reject is set out in section 286C of the Mining Act 1992 and in general, it is no more than half the rate applicable to coal. Coal reject is defined as coal that is a by-product of the mining or processing of coal that contains a mixture of coal and other substance (such as shale) and has either an energy value of less than 16 gigajoules per dry tonne or contains more than 35 per cent ash by dry weight.

Petroleum royalties

Royalties are payable at the rate of 10 per cent of the 'well-head value' of petroleum. The well head is the point where the petroleum product reaches the surface and the 'well-head value' is defined as the revenue less certain expenses incurred downstream of the well head.

Mineral (non-coal) royalties

Mineral (non-coal) royalty is calculated in the following two ways:

- Quantum royalty - Quantum royalty is applicable to minerals with a low value to volume ratio such as gypsum, limestone, and clays. A flat rate is charged per unit of quantity; for example: 35 cents for each tonne of structural clay extracted.

- Ad valorem royalty - Ad valorem royalty is applicable to minerals with a high value to volume ratio such as gold and silver. Royalty is calculated as 4 per cent of the value of production less allowable deductions.

Refer to the Non-Coal Mineral Guidelines for Compliance (PDF, 360.11 KB) for additional information on non-coal mineral royalties, including allowable deductions.

2024 Value of Coal Recovered Ministerial Determination

A new Value of Coal Recovered Ministerial Determination (2024 Coal Determination) for determining the value of coal was introduced on 1 July 2024. The new 2024 Coal Determination revokes and replaces the Coal Determination dated 31 December 2008 and provides increased certainty for leaseholders about their royalty obligations.

The changes in the 2024 Coal Determination will be required from the July 2024 return onwards. Many of the changes in the 2024 Coal Determination have already been implemented through operational reforms to the Royalty Online Services (ROS) system made by Revenue NSW.

For a summary of the changes, please see the 2024 Coal Determination Fact Sheet (PDF, 74.51 KB).

Beneficiation rates 2024-25

Beneficiation is the process of removing impurities from mined coal to improve its quality. Beneficiation costs for coal recovered under a lease and disposed of during the royalty period are claimable as an allowable deduction.

The 2024 Coal Determination provides for an annual increase in the beneficiation rates for each of the three financial years commencing 1 July 2024.

The beneficiation rates are to be increased in line with the consumer price index as outlined in the 2024 Coal Determination.

The beneficiation rates for 2024-25 are:

- Coal subjected to a full cycle of washing - $3.63 per tonne.

- Coal subjected to wet jigging - $2.08 per tonne.

- Coal crushed and screened, but not subjected to a washing process - $0.52 per tonne.

For further information

Contact the Resource Economics Unit.